On March 11, 2025, at 01:45, the Bitcoin price dropped to $76,700, the lowest point in four months, following a weekly 6% decline in the S&P 500 index. The broader stock market correction brought the index to its weakest level in six months, driven by increasing concerns about a global economic downturn among investors. Although Bitcoin (BTC) is 30% below its record of $109,350, four key indicators suggest that this correction may have reached its bottom.

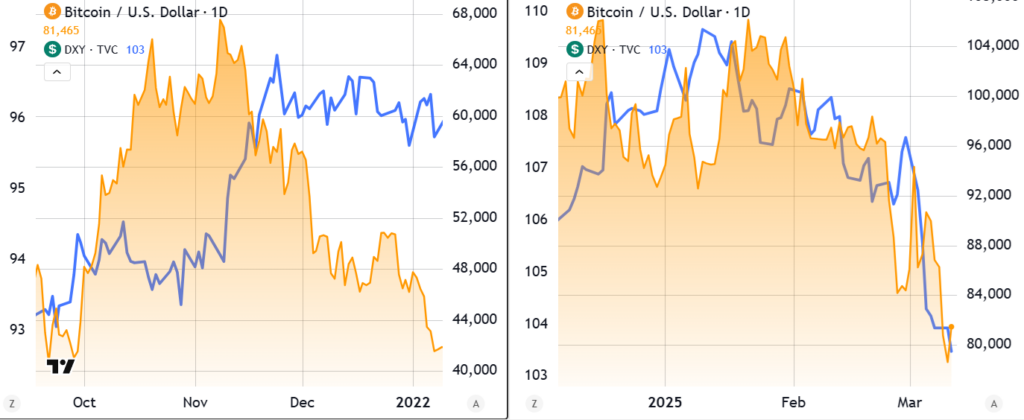

Some analysts speak of a Bitcoin bear market, but the current situation is significantly different from previous crashes. In November 2021, BTC dropped 41% – from $69,000 to $40,560 – in just 60 days. A similar decline now would bring Bitcoin to $64,400 by the end of March. This correction seems much milder. Moreover, the DXY index (US dollar) rose from 92.4 to 96.0 in 2021, while it has dropped from 109.2 at the beginning of 2025 to 104 now. Bitcoin inversely correlates with the DXY and is seen more as a risky asset than a safe haven. There are no signs that investors are massively fleeing to cash, which supports the price.

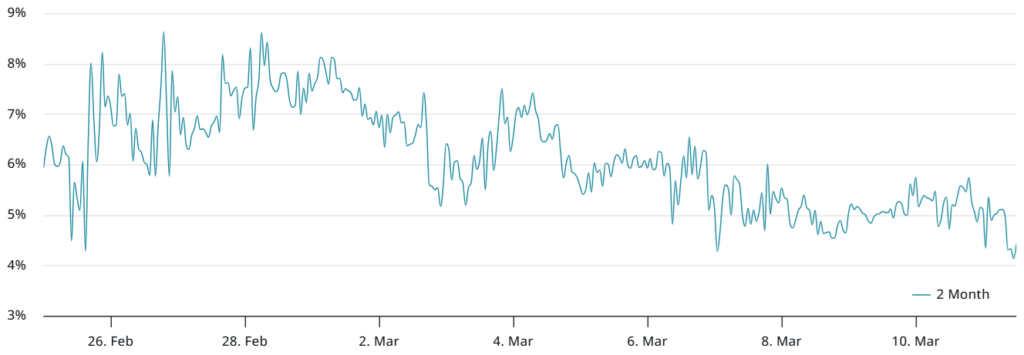

The Bitcoin derivatives market is holding up. The annual futures premium is at 4.5%, despite a 19% price drop between March 2 and 11. For comparison, on June 18, 2022, it fell below 0% after a 44% crash ($31,350 to $17,585) in 12 days. The funding rate of perpetual futures fluctuates around zero, indicating a balance between long and short positions. In bearish times, it often falls below zero due to excessive short pressure – we don’t see that now.

The broader risk market is faltering. Major players like Tesla (-54%), Palantir (-40%), Nvidia (-34%) and others are losing heavily, partly due to recession fears and a gloomy AI sentiment. A possible US government shutdown on March 15, due to wrangling over the debt ceiling, adds extra tension. Chairman Mike Johnson’s proposal – focusing on defense and immigration – still divides the Republicans, reports Yahoo Finance. A deal could give a boost to risk markets like Bitcoin.

Finally, an emerging real estate crisis could help Bitcoin. The National Association of Realtors reported a historic low in home contracts on February 27. The Wall Street Journal pointed out on February 23 that 7% of FHA loans are in arrears – worse than the subprime crisis of 2008. This could drive capital towards scarce assets like Bitcoin. However, this is speculation and it remains to be seen whether this will actually happen.

Bitcoin’s path back to $90,000 is supported by a weaker dollar, a milder correction pattern, stable derivatives, government risks, and real estate troubles. Is this the end of the dip, or is there more turmoil to come? The market is holding its breath. However, be cautious in the market, as there is still uncertainty in the market.